I don’t like surveys, I don’t like them. I find that they are so time-consuming, and to be fair, there are some pretty crap ones out there. However and a big however they have saved my skin several times. I mean formula for Eliza. Money to keep the lights on. When I was on my knees, lads, I made it through by thinking outside the box. Lets elevate this, lets do a Christmas Saving Challenge.

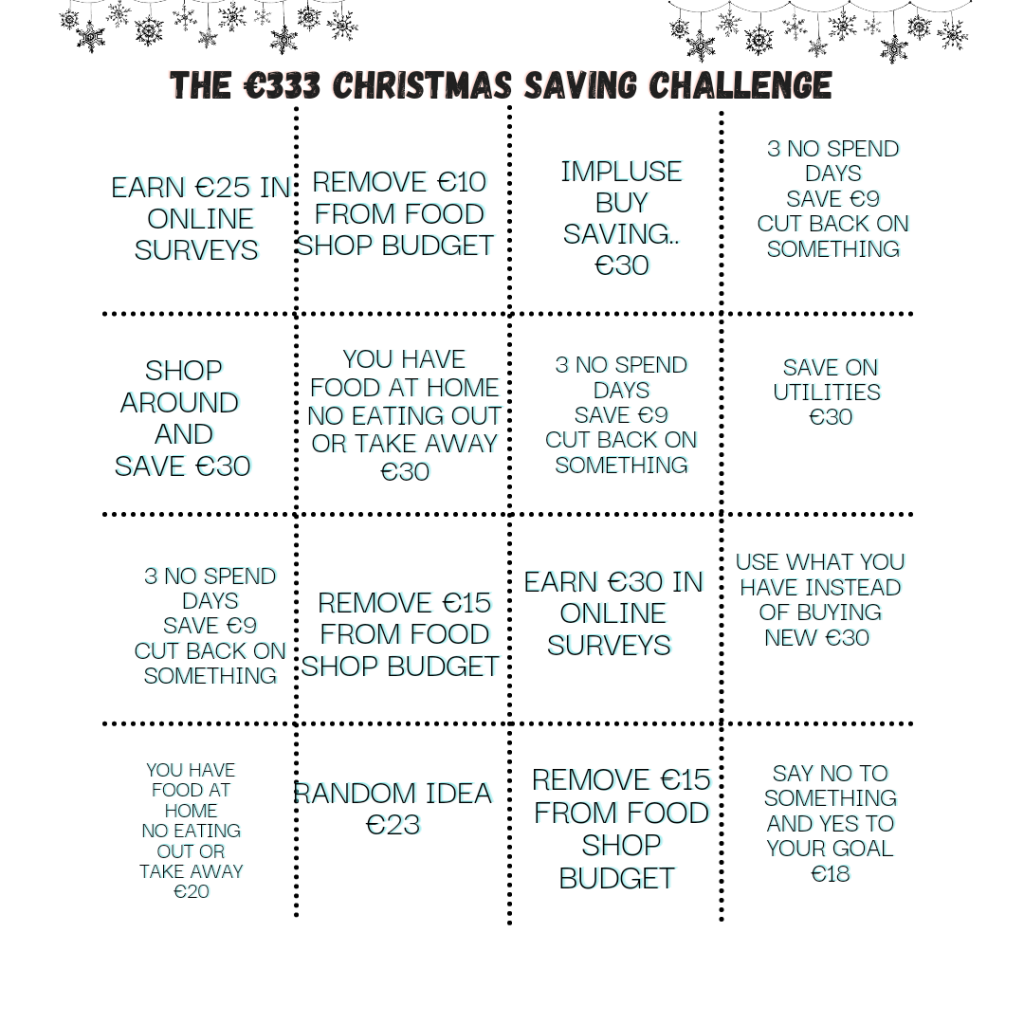

So how dare I put my nose up at anything? I have forgotten how it was. How did you manage to make extra income? The ideas provided in the 333 Christmas Challenge are exactly what you need. Lets get back to basics and let no ego stop us. Let’s go and get what’s ours!

Before I explain the method, to start off you will need something to save your money in. A physical item like a money box is a good idea. However, you could even set up a Revolut vault or a separate savings account also.

The €333 Challenge is a method of saving, but how do you save when things are already tight? You earn more!

Back to Basics

1. Surveys & Mystery Shopping

I love Attapol and YouGov quick and easy. Those are my top two. However, Mobrog is pretty regular, and so is Irish Opinions. However, these two are a little more tedious in my opinion. Please add a comment and let me know what is your favourite one is.

Mystery shopping is also a brilliant way to get some extra cash. To get more information on mystery shopping please check out my other blog post all about it.

2. Cutback on your food shop. It might sound crazy, but deciding to meal plan or shop bring a shopping list can be the difference between you making some savings on your shop. Keep an eye out for the reduced food section. Go generic on some brand purchases. When you save, that will go towards the €333 fund.

3. Guilty of picking up that credit card? I love an oul swipe up. I am buying now and paying later. We are going to cut that out, instead of buying on impulse, put that money towards the €333 Christmas Saving Challenge.

4. No Spend days. Every No-Spend day is worth €3, but you have to have 3 to earn €9. It is about time we took the yellow square to the next level. What is a No Spend Day here is a blog I wrote explaining it.

5.Look for the bargains. I don’t want to hear I’m too busy. We all are, and that’s Mr ego coming out with excuses. Super 6, reduce clothing, bulk buys. Price around. Also, if you have utilities coming up, SHOP AROUND. I did a YouTube video that you mind find interesting https://youtu.be/du0t5rSDJEk

6.You have food at home. Cut back on eating out and put the money into the €333 Christmas saving challenge fund.

“You have food at home.”

7. Comparison websites are your best friend. Pay as you go is the most expensive option. Go on the bill but make sure you get the best price; no ego here. We are loyal to our Budget, remember??

8. Consider using what you have at home instead of running to buy new clothes, shoes, makeup. Zero Waste x

I dare you to think outside of the box, what do you want?

9. Random idea, could you babysit for someone, childminding, writing a blog, sign up with a tv extra, sell online courses, dog sitting, teach English online to international students, take in students. If you want it, it’s yours.

10. If you want to go higher. If you’re going to stay the same, then do it. But if you’re doing the challenge it is worth your commitment. In the end, you will be so proud of yourself for having some coins at the most stressful and expensive time of the year x

Here is a PDF to really get you started.

Another very useful tool is in The Budget Mindset Planner, I have saving trackers at the back. This is the perfect time to use the saving tracker. Its available on The Budget Mindset Club.

Brilliant idea, thank you for sharing. I’m in 😊

You are most welcome. Let’s get this ❤💫