Money Calendar

When I was in debt and I was struggling to manage my money, one of the things that kept me in the red was being charged for missed payments. The lack of understanding and control was overwhelming. At that time, I felt that I had zero control over what was going on in my finances. I lived in fear of checking my balances and tried to just put my head in the sand until I was paid again. I would deal with it all then.

One day It all came to a head. I realised I was ignoring the problem and actually costing myself more money by doing so. It was time to do a budget NCT on myself. I did a deep dive under my financial hood so to speak. The aim was to find out exactly what was going on with my budget, how I was running out of money and crucially, how I was missing payments. I’m not going to lie, in the beginning it was a frustrating process. Seeing all of missed payment fees and what they amounted to. It would cost me 15 euro for each one and that cycle was debilitating. It was constantly putting me on the back foot.

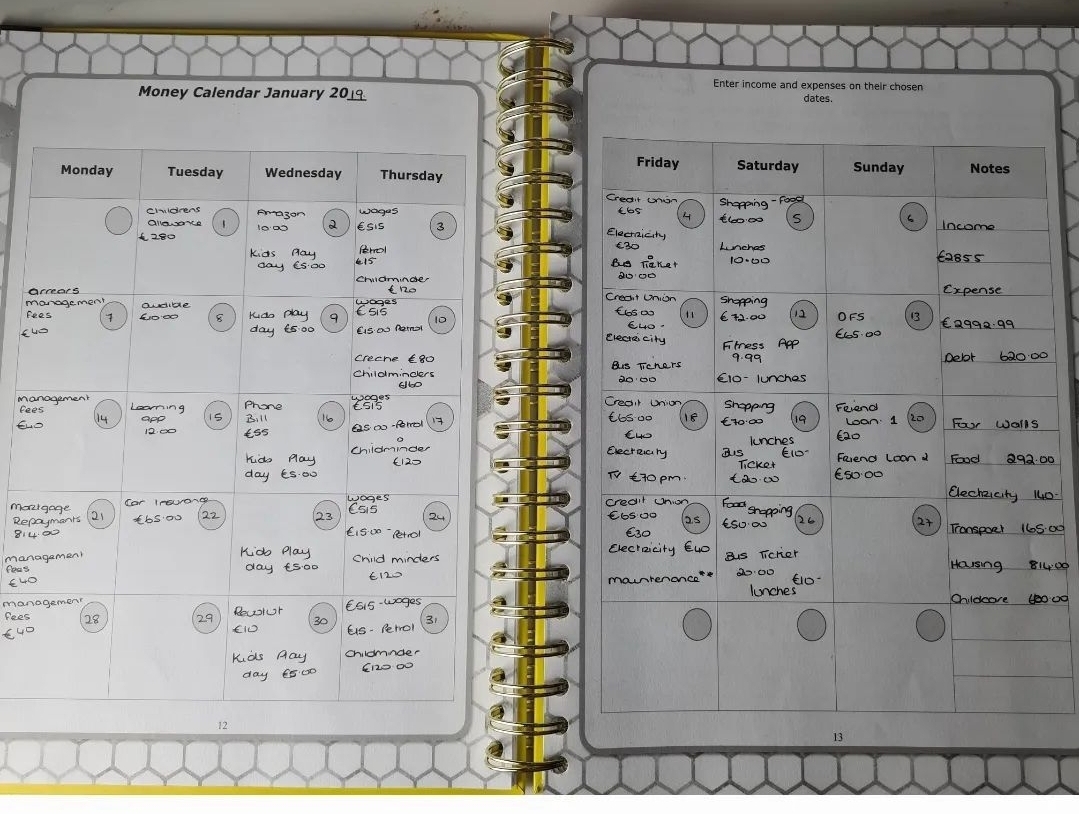

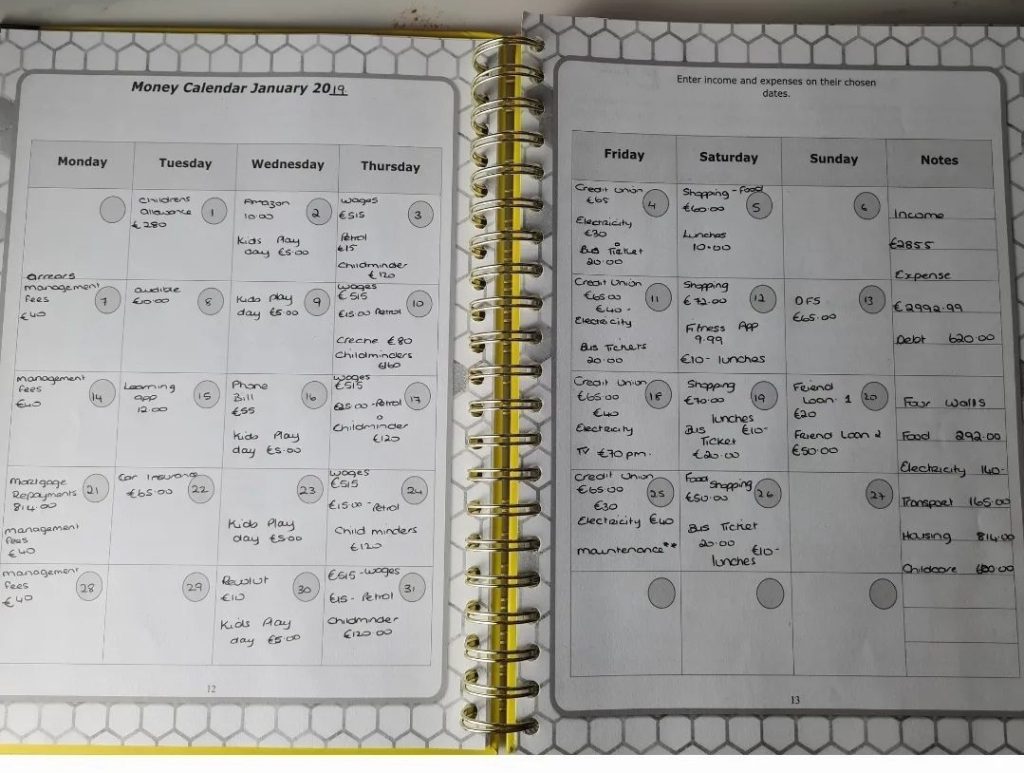

So, starting my Money Calendar was part of that NCT and yes it was worth it. Each month, I would mark in when my bills and payments were due. It made me aware of when my money was coming in and out and importantly where it was going. Subsequently, I was avoiding all the extra charges for missing payments. I was saving money just by being organised!

This was part of the thinking behind the budget mindset planner. At the start of each calendar month, there is a section for you to create your own money calendar. By completing this every month, you will start to be aware of how your money isn’t making it to the end of the month. It will make you more strategic with your spending.

Frequently Asked Questions

What exactly is a Money Calendar?

A Money calendar is a calendar that keeps track of income and expenses in order of the dates they are due. It’s a helpful way to estimate how much money will flow in and out in a given month. It can be a physical paper calendar or a digital calendar. You could even use your Google digital calendar.

By knowing when your money comes in and when the bills go out, you can better plan ahead. You might even find you need to change some of those billing dates to ensure they get paid in order of priority, or after a particular date you know you will get paid.

How Do I Use It?

Firstly, we will do a deep dive into your bank statements. We will list every outgoing and every incoming payment. We will mark them by the date they are due. By doing this you see exactly how and when your payment patterns occur. It will enable you to figure out what changes need to be made.

What are the benefits of a Money Calendar?

There are many benefits of a Monday Calendar. Some of the most impactful benefits would be that It creates awareness of your money in and out to help you to avoid missing payments. Additionally, It promotes the feeling of being in control of your finances and ultimately, alleviates the stress of the unknown. Having control with what is going on with finance also allows you to plan for the future. You will start planning ahead and saving ahead of time rather than find yourself faced with a forgotten bill. Finally, doing it as a calendar gives you a great visual representation of the information which will make it easier to digest.

So How Do I Do This For Myself?

You’re not alone. I’m here to help. My advice is to do this in two steps. Firstly, look at all of your scheduled repayments – Direct Debits and Standing Orders. These are payments that come out almost the same day every month.

As the month progresses, add in everything you spend. Absolutely everything. This might sound daunting but there are plenty of tricks to make this easier on yourself.

I vividly recall at the start of my budgeting journey, my money calendar was so full! It made me aware of some apps and transactions that I forgotten about. Start off by simplifying it. Look at all of your outgoings and really challenge yourself – do I need this, or do I want it? Now, just because its a want doesn’t automatically mean its cancelled. Look at your own budget, can you afford it and does it add to your life? We need to look after our wants where its possible. This will help you keep budgeting long term.

Many people would start the money calendar, and they wouldn’t continue. Dont give up, this is when it gets easier if you keep doing it each month. Think of the future, knowing that your car insurance is due in 6 months, and putting aside that 10 euro per week that when it comes along you’re not surprised, you’re not stressed. Its ready to be paid.

Another tip to helping yourself keep this filled out is to plan no spend days in advance. Days were you won’t have to complete your planner! You can learn more about No Spend Days here.

Need Extra Help or Motivation?

Planning ahead is a major part of saving money, reducing unnecessary charges and living a life with less financial stress.

If you need more, why not consider signing up to my free newsletter? Its full of helpful tips and motivation to live the life you want.