Based in Ireland and thinking of saving for a rainy day or an emergency fund? Then read on.

An Emergency fund, or rainy day fund, is a necessity for Financial Wellness. Most people don’t realise the necessity of saving for a rainy day. It is the ultimate need as it will save you in times of financial stress.

As a Dubliner trying to get out of debt in 2018, I struggled to find Irish resources around debt, savings, sinking funds and emergency funds. That’s why I created The Caribbean Dub, my Instagram account, which tracks how I went from in debt to financially free.

Interested in Irish Emergency Fund saving? Check out my Youtube video

Is it important to save for a rainy day?

The cost of living in Ireland is soaring so my answer is yes! It has never been more important to save for emergencies. We are living in a post-pandemic time of financial uncertainty. We need to ensure that our savings can cover us if something goes wrong.

How much should I save for an emergency fund?

The amount will vary depending on your circumstances. However, the importance of having an emergency fund does not.

When I first totted up how much I’d need to save for a rainy day, the amount was €1000. For the simple fact that:

I’m a single mother and a one income family with a mortgage in Dublin.

Therefore I needed to consider the cost of something going wrong, considering I had no-one to fall back on.

Things can go wrong pretty fast. It is a personal amount. I saved this pretty quick. As I had cash back coming from the revenue.

How much do you need in a rainy day fund?

As a rule, I’d take about one months’ expenses as a starting point for saving for an emergency. Your monthly income is a good indicator of your lifestyle; how much you spend is usually aligned with it. Take into account any large expenses you might have, and how much money you would need if something was to go wrong.

How much should be in your emergency fund is personal but stick to the one month income rule if you are in doubt.

What are examples of what an emergency fund can be used for?

Having an emergency fund is the difference between devastation and an inconvenience. When I say this you have to believe it. When my boiler broke two months after filling my emergency fund there wasn’t a whimper out of me.

The money was there to look after it. I fixed the boiler. Paused my debt pay off, refilled my emergency fund. And resumed my debt pay off. No matter the situation whether your repaying debts or saving money. Every thing is paused until your Emergency fund is refilled.

Whether you lose your job, your washing machine breaks, the car breaks down or an unexpected cost crops up, you will know when it’s time for your emergency fund to step in.

When you are starting to get your finances on track, it’s your first priority.

Irish Government rainy day fund support; what’s available?

At this time, there is no specific support for hypothetical emergencies for Irish people, meaning that it’s even more crucial for us to build a fund for ourselves to fall back on. However, there are several forms of support for people in need. More details can be found here.

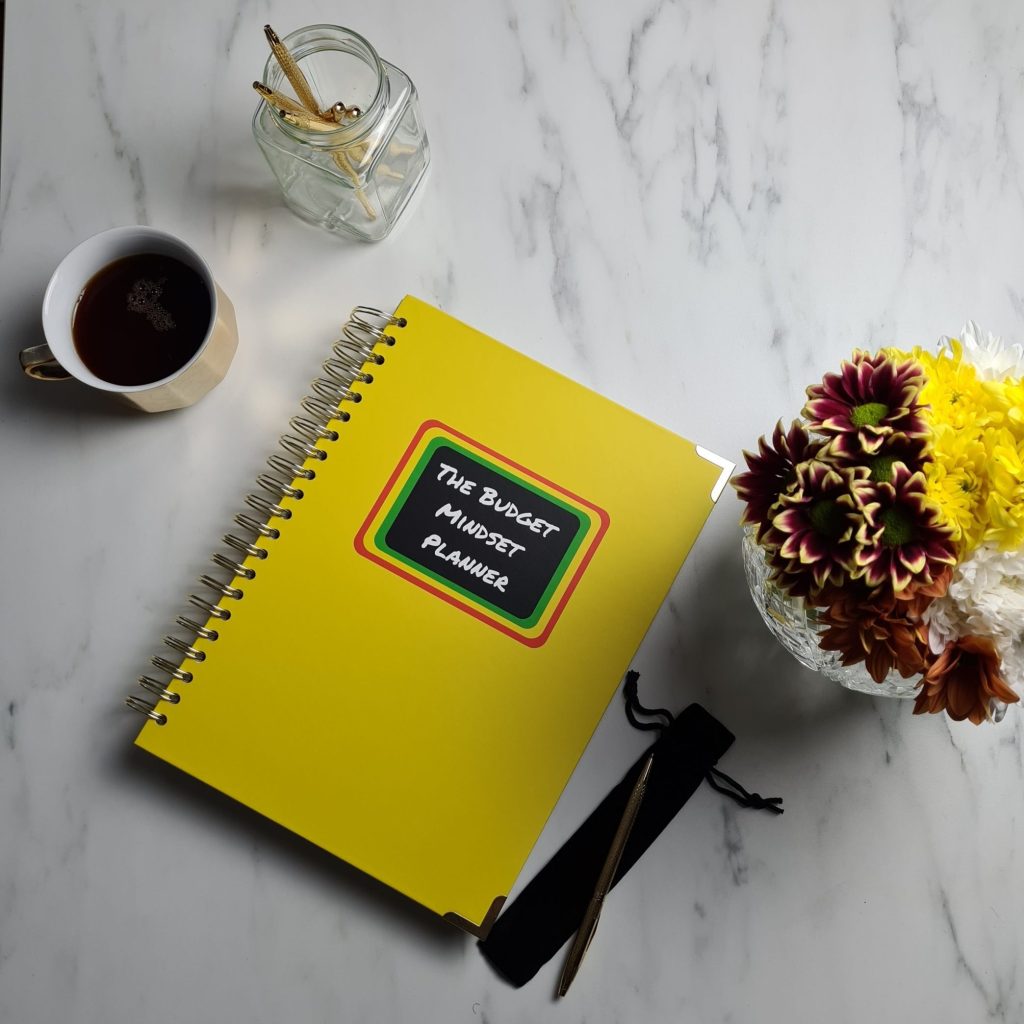

I started learning all about emergency funds via this book by Dave Ramsey. I’d recommend checking it out if you are starting out in your Irish debt free journey!

If you have any questions about rainy day savings, let me know in the comments below.