Budgeting for beginners can be daunting, especially when you have a low-income. It took me about 6 months to realise that having a budget was necessary to pay off my full €15000 debt in one year. Once I realised that budgeting was the key to making my money stretch, I got on board.

My top advice for budgeting on a low-income is to accept that it won’t always be perfect. It took six months of trial and error to figure out what worked best for my budget. My income was low, and it was difficult to cover all bases. I live in Dublin, and the cost of living is high. I have two children, and finances can be tight and unpredictable. The odds were stacked against my budget. So it took a few months to make mistakes and learn from them before I felt that I had nailed my budget.

How to budget on a low income

Here is my budget in action on my YouTube tutorial:

How to Budget on a Low-Income

Creating a budget is the same for everyone regardless of your circumstances.

List all your sources of income and all your sources of expenditure. When it comes to expenses, you have both fixed expenses and variable expenses to account for. Fixed expenses are straightforward; they are your direct debits and bills that are the same every month. Variable expenses are a little more complex; expenses such as food, entertainment and travel. These will vary month on month. Budgeting in the beginning will require you to estimate these expenses, then track them to see if your estimate is correct. This is where many people who are new to budgeting are surprised by how much they are spending.

When you are creating your budget, it is helpful to use a calendar as it visualises the direct debts, bills, loan repayments that go out, and your income coming in.

Beginning to budget is an opportunity to cancel a lot of subscriptions and only keep what is absolutely necessary. It also gives you an idea of what you are spending on variable expenses so you can reduce your outgoings.

How to Survive on a Low-Income Budget

So with general budgeting explained, let’s focus on how to survive on a low-income budget. As a single-parent family on a low income in Dublin, I am proud to say that I paid off my debt in full. Low-income budgeting is difficult, but not impossible. I cook from scratch, I spend sensibly, I am loyal to my budget over keeping up with the Joneses.

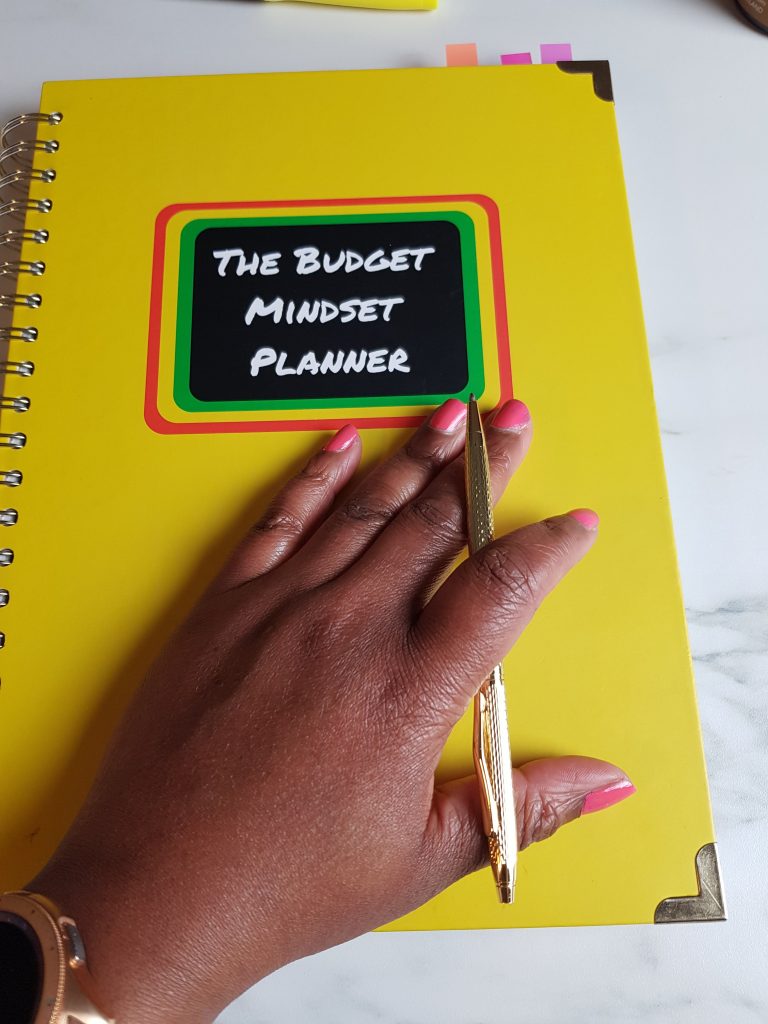

My budget became my bible. So much so, that I turned it into a planner, and now several thousand people use it to budget, too. Budgeting on a low-income taught me the right things to track and be successful with my budget, so my planner covers everything you need.

Having a spending tracker was brilliant. It gives an insight into your spending habits. Write down every time you spend money over the course of your pay period. You can do this for as long as it takes to figure out your spending habits.

10 actions you need to successfully begin budgeting on a low-income

1. You need to know when and where everything is coming and going. Make sure you have a calendar marked on the days when you are being paid. List when your direct debits are going out and when your bills are to be paid.

2. Realistically, there is no point stretching yourself so thin that your budget suffocates you. YOU WILL HATE BUDGETING, AND YOUR BUDGET WILL FAIL YOU! Your budget should become part of your lifestyle; you want it to be second nature to you, not a weekly/monthly pain in your behind.

3. Prioritise your budget. My first outgoings are my Mortgage, Food, Transport, Childcare and Utilities. Some are fixed and some are variable. These need to be covered. They are the most important elements of your budget.

4. Keep it simple! The way I budget is pretty simple; I start with my income. I have come up with my own budgeting method: the 4 families budgeting method. These are different categories in my budget. My income is passed through each family until it is used up.

5. Flex! No one gets their budget right on the first try. Play around with figures; it took me a good 6 months to get my budget to a place where I was happy with it. Things will come up, and no two weeks are the same.

6. Please, please, please put yourself in the budget. This is so important that I feel like I need to shout it out!

The all-important fun envelope is life-changing. It doesn’t have to be that much but know that it is there. Oh, and believe me when I say you will become picky when spending your own personal fun money.

7. Listen to your budget. If your walls are as low as they can be and your income doesn’t cover them, then you need to adapt. Maybe change jobs, start a side hustle, push for a pay increase or even move home; the list goes on. Now is the time to make boss moves.

8. Customise your budget to suit yourself. Don’t try to compare with what anyone else is doing; your budget should be tailored to your own needs and circumstances.

9. It doesn’t matter whether your digital or paper; honour your budget and the plans you made for your money. It’s all about the follow-through.

10. Don’t get addicted! You’ve given your money a plan, now it’s time to follow through and move on.

Thanks for this reading this. If you need more answers, leave a comment below. Budgeting for beginners is all about starting the process.